- Web3 on Fire

- Posts

- Web 3 on Fire: Crypto wallets thriving ⬆️⬆️⬆️

Web 3 on Fire: Crypto wallets thriving ⬆️⬆️⬆️

Crypto wallet and exchange markets are poised for good growth, according to a report

GM, frens! Ambire here with our weekly newsletter. Today we'll talk about SEC's Gary Gensler and his hypocritical stance on crypto, Binance pulling out of the Voyager deal, Visa hiring more crypto devs, ARB airdrop for DAOs, another fake airdrop twitter hack - this time it's KuCoin, Yuga Lab's victory in court and a report on how crypto wallet market is poised for substantial growth.

Let's get down to it:

Gary Gensler's hypocritical stance on crypto

The US Securities and Exchange Commission's (SEC) Chair Gary Gensler hasn't always been against crypto, as it seems. Recently, a video that shows Gensler lecturing at a blockchain course in 2018 has resurfaced. During his lecture he said, "Three-quarters of the market is non-securities. It is just a commodity, a cash crypto.”

The below clip is from a Fall 2018 Graduate MIT course called "Blockchain and Money"

Gary Gensler - the current President of the SEC, was the professor.

The Hypocrisy speaks for itself 🐀

"So we already know in the US and in many other jurisdictions that 3/4 of the market… twitter.com/i/web/status/1…

— zk-🦈 (@ZK_shark)

Apr 25, 2023

At that MIT lecture, he said that the debate over whether ICOs are securities “is not particularly relevant as a legal or regulatory matter” for most of the market.

However, this is in stark contrast to Gensler's current stance which has seen him label every crypto asset as security. His agency has also been active in clamping down on crypto related activities such as staking and stablecoins. It appears that Gensler has done a full U-turn from his stance in 2018. Hurting the sentiment of many in the crypto community who had seen him as an ally for their cause.

And this is not the first time he changes his mind, the video of him preaching about Algorand (ALGO) and its technology has also been released, but in a recent enforcement action against Bittrex, he labeled ALGO and several other tokens as securities. This only adds to his reputation of not standing by his word.

It is because of this that one of the US Congressmen proposed new legislation to oust him and replace him with a director that holds more consistent views. This proposed legislation is yet to be passed, but it does show how frustrated are people getting with the current leadership of SEC.

Binance is pulling out of the Voyager deal

Binance.US has pulled out of the $1.3 billion deal to acquire bankrupt crypto lender Voyager Digital due to a “hostile” regulatory climate in the United States. According to a Tuesday tweet from Binance, it has exercised its right to terminate the asset purchase agreement with Voyager. Voyager Digital also reported that it had received a letter from Binance.US, terminating the asset purchase deal.

The termination of the $1.3 billion agreement marks a major setback for Voyager Digital and its customers who had hoped to get their money back. Though Binance.US will no longer be pursuing the deal, Voyager Digital is still actively seeking interested parties to acquire its assets through a Chapter 11 plan which allows for the direct distribution of cash and crypto.

Visa is hiring more crypto devs to "accelerate adoption"

Visa still seems to be bullish on crypto, and in particular, public blockchains and stablecoins. Visa is looking to hire engineers who can work with cutting-edge tools like Github Copilot to build and debug smart contracts, as well as those passionate about the Web3 stack of technologies. With a talented team of backend developers onboard, they're hoping to drive mainstream adoption of crypto and blockchain technology.

We have an ambitious crypto product roadmap @Visa and just opened a few reqs for senior software engineers to help us drive mainstream adoption of public blockchain networks and stablecoin payments.

usa.visa.com/en_us/jobs/REF…

— Cuy Sheffield (@cuysheffield)

Apr 24, 2023

Back in February Visa rejected rumors that it was halting crypto activities, but in the meantime the company is continuing to develop public blockchains and stablecoins with an eye on mainstream adoption.

Arbitrum airdrops over $145 million in ARB tokens to various DAOs

Arbitrum is initiating the allocation of its governance token, ARB, to decentralized autonomous organizations (DAOs) within its ecosystem. 113 million tokens, worth over $145 million at current prices, will be distributed among qualified projects. The airdrop mentioned here is different from the 11.6% of tokens that were airdropped to early Arbitrum users back in March.

The Arbitrum team will be administering the distribution process to ensure that each DAO receives its appropriate share of ARB tokens. The amount allocated to each DAO will be based on their contributions and adoption of Arbitrum’s Layer 2 solutions — as well as their level of engagement with the project overall. DAOs that meet the criteria for eligibility will be able to claim their earned tokens via a smart contract system.

The projects that are expected to receive tokens include GMX, TreasureDAO, SushiSwap, Uniswap, Aave, Hop Protocol, Radiant Capital, Balancer, Gains Network, Synapse, MakerDAO, Vesta, Curve, Layer Zero, 1inch Swapr and many others. The governance tokens granted to DAOs may help bootstrap activity on the Arbitrum network. Such allocations can be used as components of their treasuries or for other objectives as decided by their communities via governance votes.

KuCoin Twitter gets hacked, CEX is offering to reimburse the victims

KuCoin's twitter account got hacked on Monday by an unknown hacker.

1/ The @kucoincom handle was compromised for about 45 mins from 00:00 Apr 24 (UTC+2). A fake activity was posted and unfortunately led to asset losses for several users. KuCoin will fully reimburse all verified asset losses caused by the social media breach and the fake activity.

— KuCoin (@kucoincom)

Apr 24, 2023

The hacker posted a malicious link to a phishing site with a fake giveaway. KuCoin has identified 22 transactions where users have lost funds as a result of interacting with the phishing site. As a result, KuCoin users have lost a total of 22,628 Tether (USDT).

KuCoin is offering to fully reimburse all verified asset losses caused by the social media breach and fake activity. KuCoin has also assured users that the hack was limited only to the social media account and that all funds on the exchange are safe. KuCoin also said that it's working on examining and blocking suspicious addresses to prevent further victimization and that it launched an in depth investigation into the incident.

The practice of hacking official accounts to promote fake giveaways and airdrops is becoming more common, as we saw with the hack of Circle’s CEO Twitter account and Robinhood's just a few months ago. Remember to always exercise extreme caution when clicking on suspicious links but also don't forget about the common sense. There's always free cheese, usually though it's in a mousetrap.

Yuga Labs secures victory in court against a copycat NFT project

Yuga Labs, creators of the popular Bored Apes NFT collection, were awarded a summary victory in court against copycat Ryder Ripps, winning on all counts.

@yugalabs@ryder_ripps Ahh man, don't sell yourself so short my G! In short, Yuga won it's case (pending appeal of course) against Ryder for Trademark infringement on almost all counts. Additionally, the 'defenses' Ryder put up ('I'm a conceptual artist, this is free speech criticism via art') failed.

— Ash Kernen, Esq (@AshKernen)

Apr 22, 2023

The legal battle began last summer when Ryder Ripps and his team were accused of ripping off (lol) Yuga Lab's Bored Apes collection, creating a copycat collection that they called the RRBAYC Collection.

Yuga Labs claimed in court that Ripps and his team had violated their intellectual property rights as well as engaged in false designation of origin.

The US Northern District Court agreed with the prosecutor's position, ruling that the RRBAYC collection was not a fair use or due artistic expression as claimed. The court also found against Ripps and his team on the false designation of origin charge and ruled that his free speech claims were not tenable in this case.

The ruling is a major victory for Yuga Labs and NFT creators in general, and shows that the court is taking digital intellectual property laws seriously. The ruling should also dissuade others from trying to copy NFT collections without the proper authorization, or else they may face legal action.

Research corner: crypto wallet and exchange markets are poised for good growth, according to a report

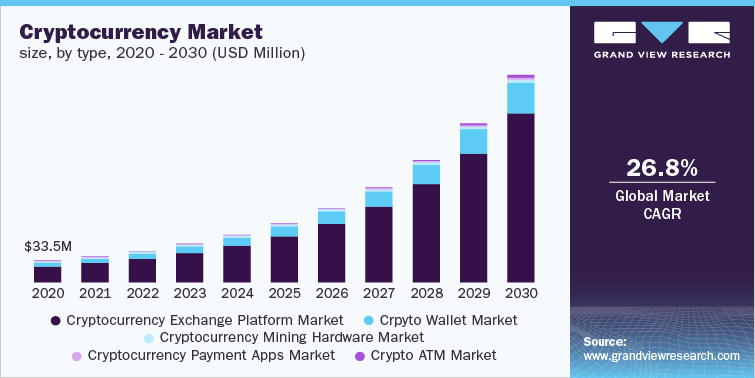

Grand View Research published a report that states the global cryptocurrency industry size fattened up to USD 40.09 billion in 2021 and is projected to show a CAGR of 26.8% from 2022 to 2030, owing to increased adoption of distributed ledger tech across various industries such as gaming, healthcare, trading, e-commerce, retail and government.

According to the report, investors and entrepreneurs alike are leveraging on crypto to reap the advantages of easy fund transfer and to remove the third parties from the transactions. This comes as no surprise due to soaring demands for blockchain across industries. Blockchain is praised for its instant traceability, speed, efficiency and automation. But what's interesting is that the ones to win the most from this are crypto exchange platforms and crypto wallets.

Both wallets and exchanges nowadays are pretty much involved in the trading process. They offer liquidity, market access, insights into pricing behavior, asset management as well as charting tools for users.

The usage of these wallets and exchanges will be further supercharged with the emergence of NFTs and various usecases. The study also talks about how the crypto wallet market was valued to be USD 6.97 billion in 2021 and is anticipated to witness growth at a rate of 24.4% at the very least over the forecast period. The security that the wallets provide are expected to play a major role in driving up the demand for crypto wallets and hence augmenting the future market growth.

Overall, the future looks bright, despite what the skeptics might say.

The fun page: our weekly meme collection

Pirates >>> https://t

— Alan Carroll (@alancarroII)

Apr 22, 2023

That's all for now, frens.

We'll see you next week. And remember, the market conditions are temporary, but our commitment to building a better DeFi is here to stay. Thanks for joining us and we look forward to seeing you back next week. Cheers!

Yours, The 🔥 Team

Brought to you by Ambire: The Web3 Wallet That Speaks Human